June saw energy markets rally to their highest levels since April, driven by a 12 day War between Israel and Iran that raised concerns about potential global supply restrictions. Markets reversed sharply following the announcement of a US-brokered ceasefire and the downward trend continued for the remainder of June.

With no long term resolution, contracts remain sensitive to further instability. Above-average temperatures and low gas-for-power demand helped sustain storage injections across Europe, supporting fundamentals and a bearish sentiment.

Power

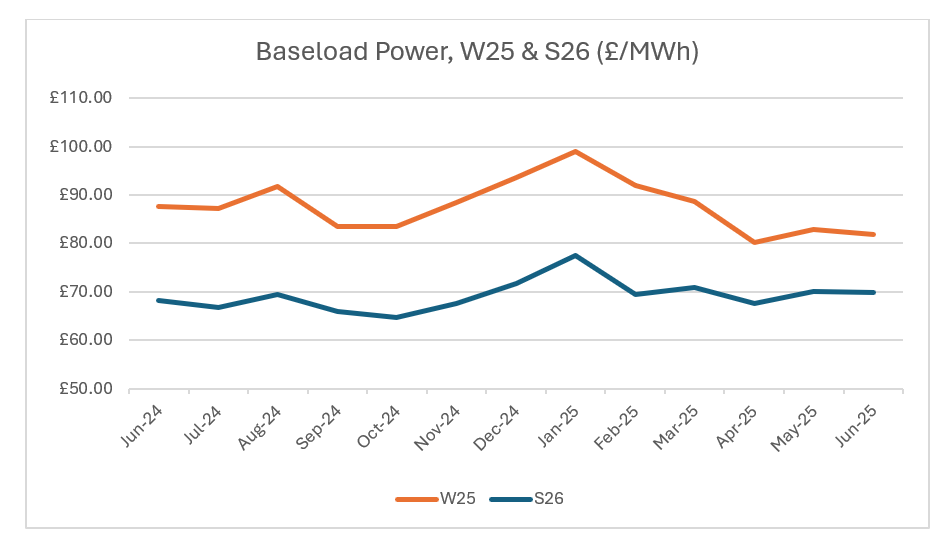

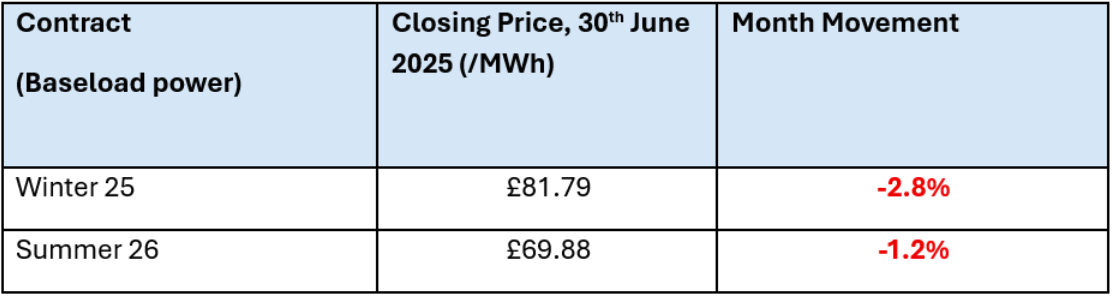

Season ahead contracts saw bullish movement for much of June. However, strong wind generation and low seasonal demand meant prices ultimately closed lower for June.

June Highs:

Winter25: £96.92

Summer25: £78.62

Gas

Europe’s storage outlook is improved across Europe, sitting at 60%, with robust LNG imports and steady injection rates. Fears over the potential closure of the Strait of Hormuz, a key route for LNG from Qatar and the UAE (which supply 8.5% of Europe’s LNG) led to a mid-month price surge.

Looking ahead

- A heatwave and low wind generation is forecast across much of Europe in early July, as well as curtailed French nuclear output, likely boosting gas-for-power demand.

- Geopolitical developments in the Middle East and any change in ceasefire agreements could impact markets

- Market attention will also remain on upcoming tariff negotiations with the US

The Greenspan Agency produce this report on a best endeavours basis, and it has been supplied for your interest; the facts in this report should not be relied upon for decision making. If you have any queries about the content in this report, please contact bureau@greenspanenergy.com

Contact Alba EnergyContact Us

Send us a message

or enquiry

"*" indicates required fields