Overview

Power markets saw uplifts at the beginning with below average wind but were kept steady by improved renewable generation for the remainder of the month. Revised August forecasts see above average temperatures in Europe, increasing cooling demand and saw some upward movement. Geopolitical developments continue to play a key role in driving the market. President Trump threatens imminent sanctions on Russia as well as those countries that trade with them. Gas storage levels see improvements but will remain sensitive to any changes in global LNG supply.

Power

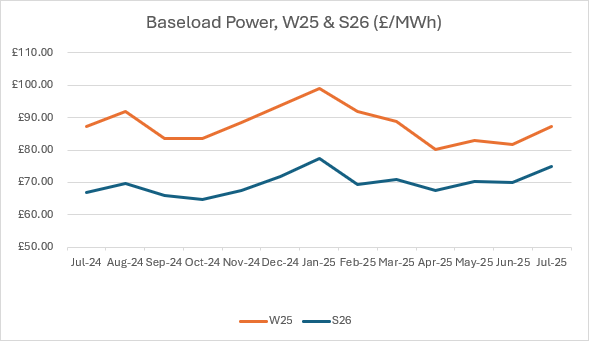

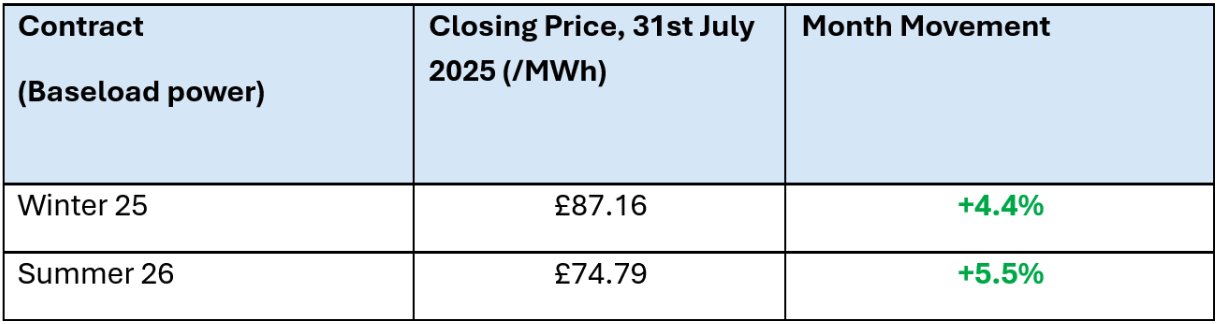

Season ahead contracts saw bullish movement for much of July and closed at the highest price since April 25. Strong renewable generation steadies the market but cooling demand sees the need for gas-for-power.

Gas

LNG supply to Europe has been consistent throughout summer, allowing much needed refilling of storage, though imports have slowed recently. Asian cooling demand has remained relatively subdued this season; however, forecasts expect demand to rise going into August and could impact LNG availability. Centrica announced towards the end of July that it will produce the remaining gas at Rough, the UK’s largest storage, rather than store gas, the market reacted bearishly.

Looking ahead

- Calm markets but high risk of volatility remains as we head into winter

- Risks remain with Asian cooling demand, and the US hurricane season could constrain LNG supply

- Russia/Ukraine peace deal seems unlikely in the short term, and potential sanctions ensure no Russian supply will support Europe

- LNG supply to ramp up globally, though there are potential Qatari delays

Energy News – Zonal Pricing

The UK Government has announced that they will not proceed with the zonal pricing. The proposed change would mean each ‘zone’ across the UK would have a different electricity price, with areas of high generation, such as Scotland, would have lower prices for consumers. The government will not proceed with this and instead they are to reform the existing national pricing system. This is a welcomed outcome and beneficial for all generators in Scotland.

The Greenspan Agency produce this report on a best endeavours basis, and it has been supplied for your interest; the facts in this report should not be relied upon for decision making. If you have any queries about the content in this report, please contact bureau@greenspanenergy.com

Contact Alba EnergyContact Us

Send us a message

or enquiry

"*" indicates required fields