July saw a return of the UK’s symbolic wet weather, in contrast to the record (and worrying) heat waves on the continent. The European drought had some unexpected consequences on commodity prices, with limits to barge sizes implemented on the Rhine (a key transport route for oil) due to the exceptionally low river levels.

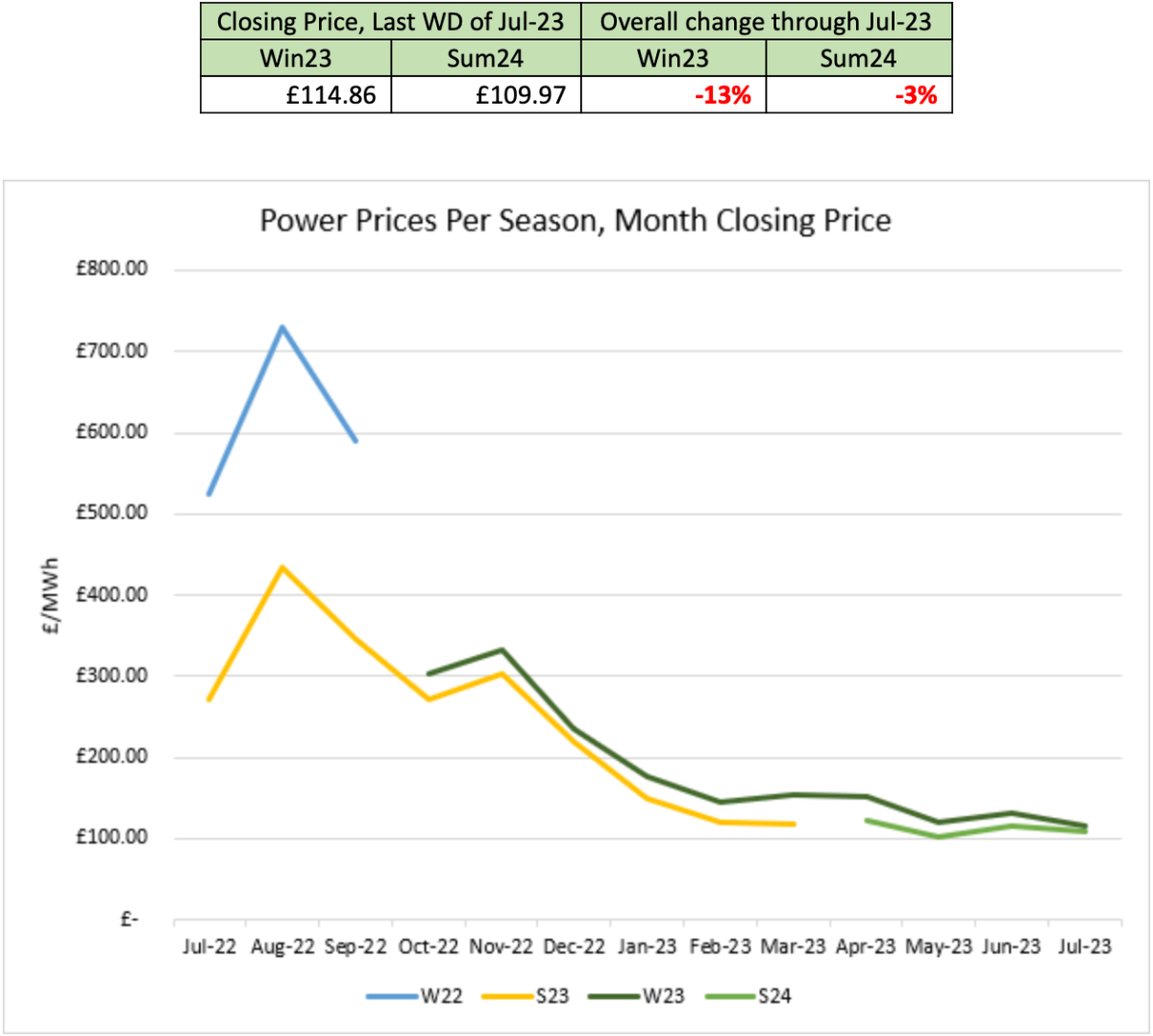

Power prices were volatile throughout the month, responding to fluctuations in renewable and gas output. European and UK gas storage remains extremely healthy at c.a. 80% and 75% full respectively, dampening any price rises. Whilst the outlook for July was mixed, the overall trend saw Winter23 and Summer24 pricing decrease by 13% and 3% respectively.

The start of July saw high wind output (20% above seasonal norms), resulting in the UK being a net power exporter for a time. Whilst there were some sporadic, minor, increases in power pricing due to low wind output, these were short lived.

Outages at the Norwegian Troll field dominated July. Prices softened in the second week of the month following the announcement in the second week of the month that the maintenance severity would be decreased. Despite the low LNG supply, UK gas storage was 75% full by 07th July. This, coupled with wind power achieving 50% higher outputs than June 2023, largely led to a continued decrease in power pricing.

Mid-month saw a change in trend. Whilst the high wind levels continued to dampen any price rises following the announcement of halts in the Dragon LNG supply, high carbon prices began to feed into higher power pricing. Furthermore, an extension of Nuclear outages in France added upward pressure to the market.

The end of the month saw high wind output and healthy gas storage levels, despite lack of UK-bound LNG cargos. Wind remained 20% above seasonal levels, whilst solar output sat 10% below the norm.

As always, it’s unclear where the market will head in the coming months. For now at least, power prices seem more settled than they were at the start of the year.

The Greenspan Agency produce the report on a best endeavours basis and has been supplied for your interest; the facts in this report are for background information and should not be relied upon exclusively for decision making.

If you have any queries about the content in this report, please contact amy@greenspanenergy.com or lara@greenspanenergy.com.

Contact Us

Send us a message

or enquiry

"*" indicates required fields