Stable fundamentals have contributed to a continuing downward trend into April. Robust solar and steady wind generation supported renewable output and above-average temperatures saw low heating demand, balancing any short-term uplifts in the market.

Geopolitical tensions continue to be a major influence on the market. The ongoing Russia-Ukraine war has played a significant role in this. Markets softened towards the end of April as the potential for a ceasefire agreement between Russia and Ukraine seemed more promising than in previous months. However, ongoing negotiations keep the market in a state of anticipation. In addition, U.S.- China trade tensions have escalated, with the U.S. imposing new tariffs and China responding with retaliatory measures. These developments have further weakened the gas market amid increasing concerns about global economic growth.

Power

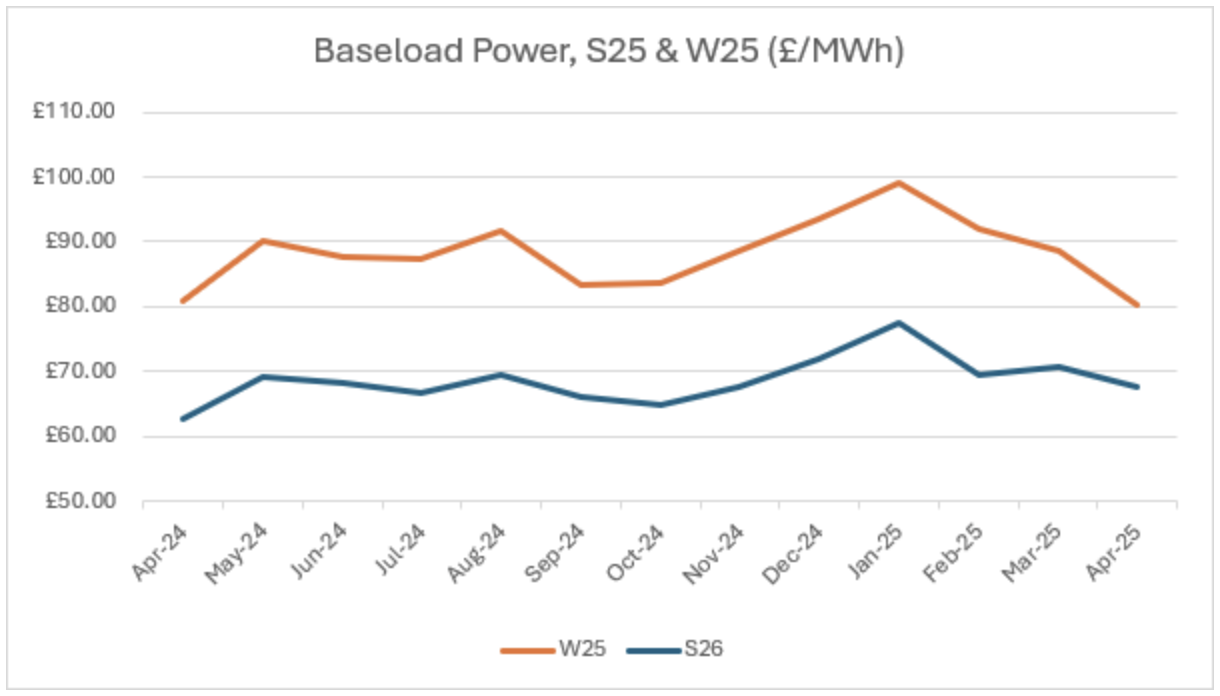

Seasonal contracts for baseload power had a bearish sentiment throughout.

The REGO markets have dipped even further for CP23 (Apr24-Mar25), now trading at £0.30 for WSH and £0.25 for Bio—a dramatic 98% reduction compared to CP22, but back to where they were historically. Increased renewable generation has seen REGO supply rise, while demand has slumped, with corporates and two of the large suppliers stepping back from purchases. This has driven down market prices.

| Contract

(Baseload power) |

Closing Price, 30th April 2025 (/MWh) | Month Movement |

| Winter 25 | £80.15 | -13.80% |

| Summer 26 | £67.56 | -6.3% |

Movement over 1 year, S25 and W25

Gas

Warmer temperatures have led to reduced withdrawals and have allowed for early storage injections, indicating that the UK and Europe could reach storage targets by Autumn. Asia’s subdued demand helps UK and European markets attract LNG imports, with three more vessels due to arrive this month, keeping an overall bearish outlook for gas markets.

Looking ahead

Russia is expected to observe a ceasefire with Ukraine from 8th to 11th of May in honour of the VE Day anniversary, and additionally, Ukraine and the United States have signed a deal regarding natural resources. Negotiations over the upcoming months are likely to influence gas and power markets significantly. The future LNG supply outlook is strong, with further availability as the U.S. invests in expanding its production plants and with Asian demand curtailed.

The Greenspan Agency produce this report on a best endeavours basis, and it has been supplied for your interest; the facts in this report should not be relied upon for decision making. If you have any queries about the content in this report, please contact bureau@greenspanenergy.com

Contact Alba EnergyContact Us

Send us a message

or enquiry

"*" indicates required fields