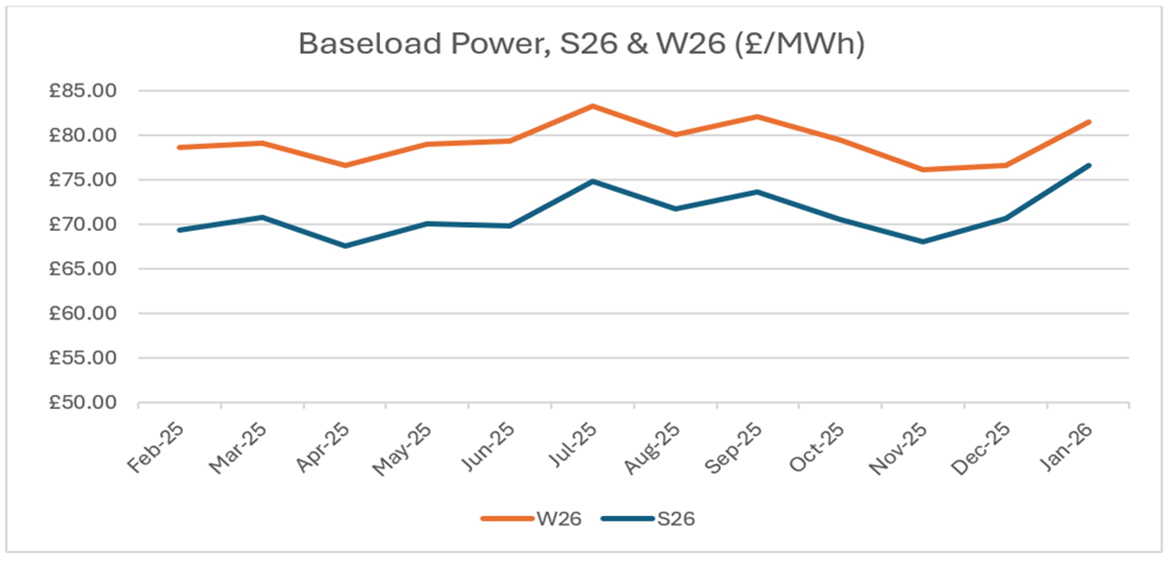

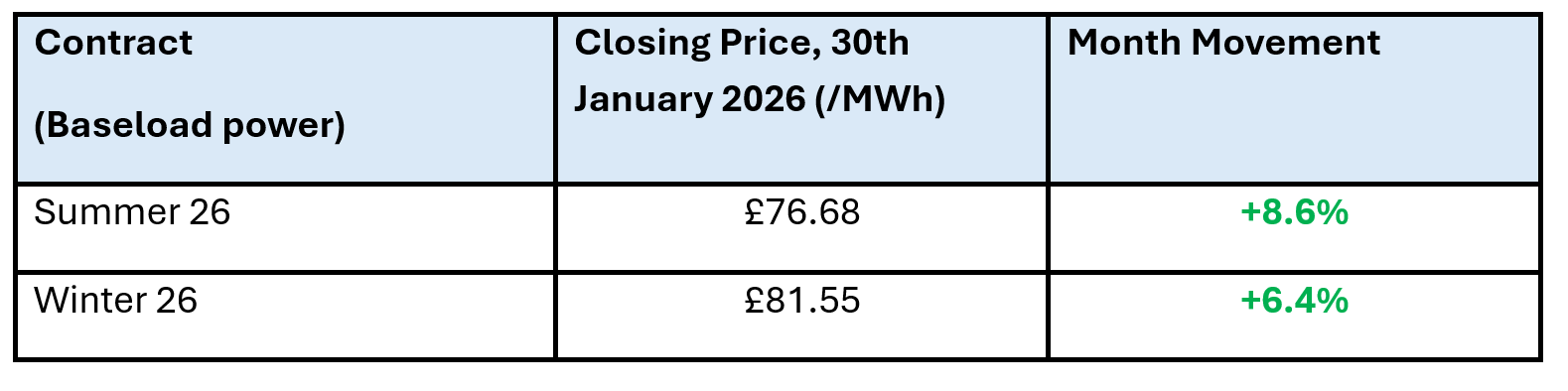

A period of milder weather forecasts in the middle of the month provided temporary relief. Prices resumed their upward trajectory after reports suggested that Europe’s gas storage levels could fall to record lows by the end of the season. This concern was amplified by reduced LNG output in the United States, where a cold snap disrupted production. Though, early February saw a significant reversal for both gas and power markets with news of milder weather, increased LNG output, and some easing of geopolitical tensions that alleviated supply concerns.

Power

Gas

Increased storage withdrawals over January see EU storage drop to 45% fullness, 11% lower than last year. In addition, a cold snap in the US saw a reduction in LNG output towards the end of January. Only 36 LNG cargos to arrive in Europe this February, compared to 110 received last year. Summer26 contracts are pushed up further to meet the demand to replenish storage. Though this concern was short-lived, as revised forecasts see US LNG output ramp up once again from start of February.

Looking ahead

- Short term, winter risk will continue to play a role

- Continued monitoring of storage trends and LNG flows

- Geopolitical drivers may have an influence as tensions escalate globally

FiT Tariff changes 2026

The government has proposed changing the way the Feed-In Tariff (FiT) scheme is indexed to inflation.

They are proposing that FiT tariff rates are to be linked to Consumer Price Index (CPI) rather than Retail Price Index (RPI).

The consultation is ongoing, and once completed, the FiT tariffs for 2026-27 will be published.

The Greenspan Agency produce this report on a best endeavours basis, and it has been supplied for your interest; this report should not be relied upon for decision making. If you have any queries about the content in this report, please contact hana@greenspanenergy.com

Contact Alba EnergyContact Us

Send us a message

or enquiry

"*" indicates required fields